Advertiser Disclosure

Debt Consolidation: What You Need to Know

Updated On September 30, 2024

Editorial Note: This content is based solely on the author's opinions and is not provided, approved, endorsed or reviewed by any financial institution or partner.

Debt consolidation can help you consolidate credit card debt, organize your debt and lower your interest rate.

Here’s everything you need to know about debt consolidation can how it can help you save money starting now.

What is debt consolidation?

A debt consolidation loan is an unsecured personal loan that allows you to combine your existing debt and replace it with new debt at a lower interest rate.

Debt consolidation is an effective strategy to pay off credit card debt, personal loans or other debt. With debt consolidation, you can organize multiple types of debt with different payoff amounts and different payoff dates into a single loan.

Debt consolidation has many key benefits. Let’s explore a few.

Debt Consolidation: Key Benefits

Here are the key benefits of debt consolidation:

- Lower your interest rate

- Combine all your debt into a single loan

- Simplify your payments

- Make a single payment

- Helps you get organized

- Change payment amount to make it more affordable for you

- Save money

- Eliminate high credit card interest rates on your credit card debt

When you consolidate credit card debt, you eliminate your existing debt and instead replace it with a new loan, new interest rate, new payment schedule and new payoff debt.

Here are the most effective ways to use debt consolidation to your advantage. Let’s take a look how.

3 Ways To Use Debt Consolidation Effectively

Here are three of the most popular strategies to use debt consolidation to help you improve your finances.

1. Get a lower interest rate

A lower interest rate is one of the top reasons for debt consolidation.

With debt consolidation, you can receive a lower interest rate with a low cost, fixed rate personal loan. When you have a lower interest rate, you can save significant money in interest costs, and pay off your debt faster.

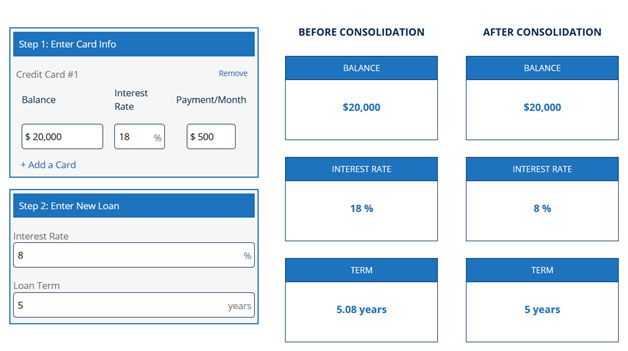

Let’s look at an example with this credit card consolidation calculator.

Let’s assume that you have $20,000 of credit card debt at an 18% interest rate. Let’s assume that you can consolidate credit card debt with a personal loan with an interest rate of 8%.

With this credit card consolidation calculator, you can see that you will save $94 per month, and your total savings on your credit card debt would be $6,168.

As you can see, debt consolidation can save your significantly when you combine your credit card debt into a single personal loan.

So, how do you get a lower interest rate?If you have raised your credit score since you borrowed your original debt, that can help you get a lower interest rate. Whether you have good or strong credit, you may qualify for a lower interest rate than the high-interest rates that come with credit cards.

You can check your rates for free in two minutes and get a personalized quote for a new rate from these trusted lenders.

2. Change your monthly payment

One benefit of debt consolidation is the ability to change your monthly payment.

Your monthly payment is based on your loan term (how long you have to payoff your debt), the amount of debt and the interest rate.

When you consolidate credit card debt, for example, you can receive a lower interest rate and choose your loan term. Those are the two levers can you can pull to save money.

You can decrease your monthly payment by increasing your loan term and thereby extending your payoff date.

You can increase your monthly payment by decreasing your loan term and thereby shortening your payoff date.

Whichever choice you make, you should make sure it is best for your specific financial situation.

3. Change your loan payoff date

Here’s a secret: the amount you pay each month for your current debt is based on your payoff date, which is known as your loan term. The good news is that with debt consolidation, you can change your payoff date and change your loan term.

Here’s how.

The longer your loan term, the less you will pay in interest each month. However, it will take you longer to pay off your loan. The shorter your loan term, the more interest you will pay each month. However, you can pay off your loan in a relatively shorter time period.

So, you need to decide what type of loan term is best for you and works best for your financial situation. If you want to pay off your loan as quickly as possible – whether it’s a student loan, credit card debt or personal loan – choose a relatively shorter loan term. Yes, your monthly payments may be higher, but you will save money in the long-term.

If you need more time to pay off your loan, remember that even though your monthly payments may be lower, you will end up paying more over the life of your loan. However, it may still be cheaper to do that rather than keep your existing debt at a higher interest rate.

You can use this helpful monthly loan calculator to see how much you would pay each month under different scenarios. For example, a $10,000 loan at 8% interest payable over 5 years would mean a monthly payment of $203 and a total payment of $12,166.

Top 3 Things To Avoid With Debt Consolidation

Here are 3 things you should always avoid with debt consolidation:

1. Focus on APRs

An APR, or annual percentage yield, is the interest rate of your loan plus any origination fees.

Pay attention to the APR, not only the interest rate.

Personal loans and credit card consolidation loans often come with origination fees, which is industry standard. So, you shouldn’t be surprised if you see origination fees, which typically can range from 1-5% of your loan balance.

So, when you look at the APR, you’ll have the full cost, including interest costs and fees.

The good news is that even when you look at the APR, it can often be lower than the interest rate on your current debt.

2. Avoid debt consolidation companies

You don’t need a debt consolidation company to consolidate credit card debt.

You can consolidate debt with a credit card consolidation loan or personal loan online in minutes. Most importantly, you can compare the best, high-ranked lenders and find the best one for you.

Debt consolidation companies often over charge you and ask you to pay unnecessary fees. If you shop around and apply online yourself, you can save substantially compared to a debt consolidate service. Beware so you don’t fall for a debt consolidation scam.

3. Get a debt repayment strategy

A debt repayment strategy can help you get organized, stay organized and pay off your debt faster.

Just because you got in debt doesn’t mean you have to stay in debt.

Debt consolidation is your first step to get your finances under control. Whether it’s a student loan, credit card debt or a personal loan, you can consolidate debt and save money with a lower interest rate.

Understand the reasons why you went into debt, control spending and don’t borrow money you can’t afford to repay.

Most importantly, don’t spend money on a credit card if you can’t pay it back each month in full.

Don’t skip payments and always pay on time.

Should I consolidate my debt?

Debt consolidation is an excellent tool not only to organize your debt but also to lower your interest rate and save you money.

If you are happy with your interest rate and think it is already low, then debt consolidation may not be the best choice for you because it may not make good financial sense.

However, if you think your interest rate is high, you can compare your current interest rate to the latest, personalized rates available today. When you comparison shop, you can find the best lender for you to help save you money.

Remember, you can also choose your payoff date and loan term, and that will help you decide whether to extend or shorten how much time it will take to pay off debt.

With debt consolidation, many people prefer to payoff debt as fast as possible, which is why the choice to consolidate debt can be a very good one.